Global creditors will discuss the inclusion of domestic debt in restructuring plans for countries in default next week, two sources with direct knowledge of the matter told Reuters, a sign of progress after months of delays.

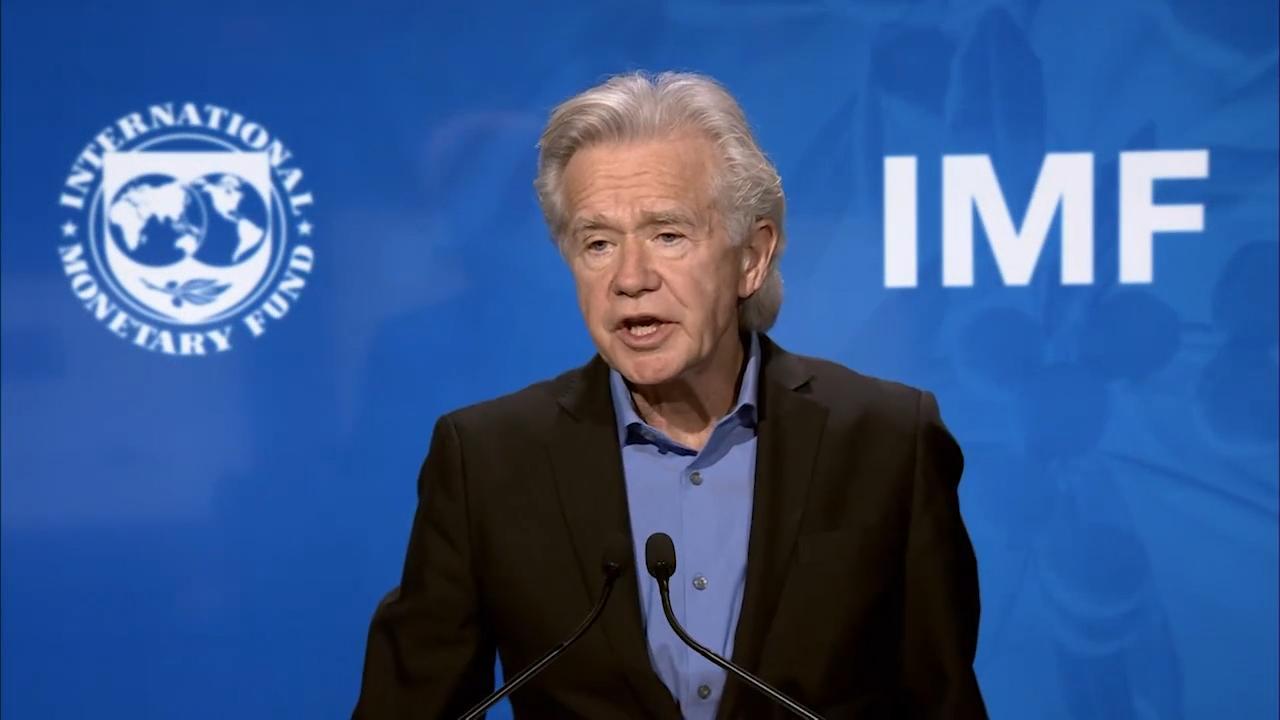

The Sept. 15 technical meeting of the Global Sovereign Debt Roundtable will include representatives, likely at deputy level, of the International Monetary Fund (IMF), the World Bank, and the Group of 20 (G20) major economies.

The talks will also cover the risks of local debt restructuring, such as second-round effects, said one of the two sources, who spoke on condition of anonymity.

They are expected to prepare the ground for a more high-level reunion during the MF-World Bank meetings in Morocco on October 9–15.

Countries such as Sri Lanka and Ghana recently included part or all of their domestic sovereign debt in ongoing debt restructurings after falling into default, though Zambia did not.

There is no common restructuring template for countries in default, with governments often deciding how to treat local debt in the wake of an IMF debt sustainability analysis.

Overseas private creditors often push for burden sharing with domestic creditors during such debt restructurings. Governments tend to be reluctant over concerns that such a move could lead to instability in their financial sector, as domestic banks and pension funds are usually the biggest holders of these bonds.

An IMF spokesperson confirmed the meeting and said that domestic debt restructuring “is among the several issues identified as challenges to debt restructuring.”