It appears the government is not seeking third party intervention such as from China to overcome the present economic crisis other than a few currency swaps from India and China or other neighbouring countries. The insights of the Finance Minister in the global financial market is more prudent than ever before and is associated with objectivity.

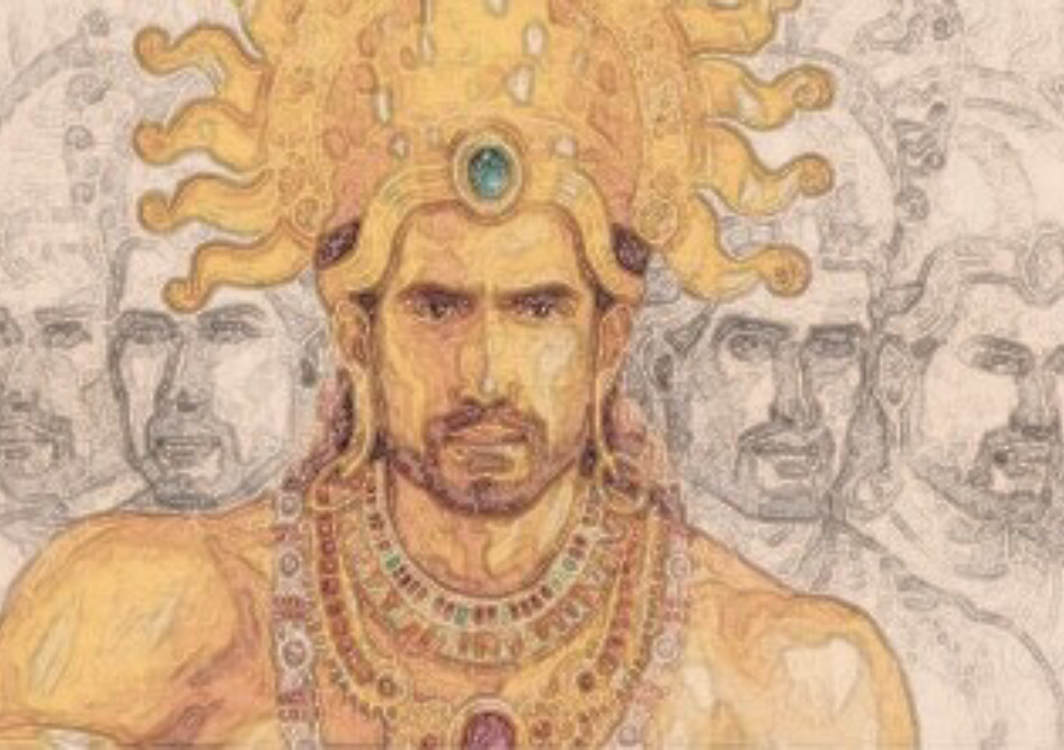

Ravana’s column by Alakeshwara

Basil Rajapaksa, the latest member of the Rajapaksa oligarchy to join the Sri Lankan cabinet as the pivot controlling the finances, trekked on a rather arduous and unusual path to convince others of the complex and intricate nature of the economic situation the country is facing today.

Unlike Ajit Nivard Cabraal, the State Minister of Finance, he was direct in his admission that we are going through an economic regression mainly due to the dreadful Covid 19 pandemic and due to the long-drawn-out accumulation of the debts that are posing a grave threat to the economy.

“The pandemic alone cost us nearly 1500 billion rupees, and of the vaccines received in the country, nearly 80 per cent cost us dearly”.

Rajapaksa said he did not want to make his speech a political discourse nor did he want to blame anybody for the economic ills but requested the cooperation of the Opposition to salvage the country from the present innate fragile state of affairs.

He compared the country’s situation to the proverbial man who was raring to have the taste of honey while facing imminent death in three ways.

He outlined three key sources from which the state is earning money for recurrent expenditure, the Customs Department, Excise Department and the Inland Revenue Department.

The income through the Customs Departmentfell drastically owing to import restrictions. The impact caused by the ban on car imports to save foreign exchange reserves of the country impacted the state enormously.

Many in the Opposition listened to his litany of woe quite attentively. However, the initial mistakes they committed to give tax concessions to bigtime businesses soon after the SLPP assumed office never attuned to his focus.

This step, taken by the then Finance Minister Mahinda Rajapaksa, affected the income of the State coffers severely because of the reduction of Value Added Tax. It gave a fillip to business entrepreneurs but caused untold damage to the Treasury generally. The tax relief put the country in an awkward position creating a large deficit between the state income and expenditure and encouraging borrowings from outside sources.

The new finance minister, in his maiden speech to Parliament, invited the cooperation of the Opposition to venture into an era of economic stability with a somewhat complacent attitude.

He wanted to overcome the present economic meltdown in practical terms while underscoring the efficiency of the export market, which was a sigh of relief to the government amidst a vast array of problems in his basket.

Other than a few currency swaps from India and China or other neighbouring countries, it appears that the government is not seeking third party assistance such as from China to overcome the present crisis. The insights of the Finance Minister about the global financial market is more prudent than ever before and is associated with objectivity.

The Finance Minister underscored his intentions to reach out to global lending institutions such as the World Bank and the Asian Development Bank to obtain assistance.

The announcement invariably brought a glimmer of hope that he is spontaneous in his inclination to create a robust economy despite the trajectory that may seem arduous in achieving economic recovery.

It is pretty much an indication that the government, under the prevailing circumstances, is reluctant to seek financial assistance from commercial sources at much higher rates.

Contrary to the days of Mahinda Rajapaksa, where Chinese commercial loans flooded the country with relatively higher interest rates attached, the present administration may explore more viable avenues to reach the target.

The frequently spoken Chinese debt trap was laid meticulously over the preceding years pushing the country to consider the need for a real “bailout” from an institution such as the International Monetary Fund (IMF) to restructure the economy and re-schedule the loan commitments.

The Finance Minister however omitted the IMF from his dossier on how to revamp the ailing economy. Nevertheless, there were moves by some who advised the government of ways and means for a logical and rational intervention by the IMF. It was an option that the government ought to pursue.

The main characters against the move are P.B Jayasundera and Nivard Cabraal. They are supposed to be the economic pundits of the government.

More recently, none other than Wimal Weerawansa portrayed P.B Jayasundara as an economic assassin in the government. The Supreme Court recently passed strictures on him holding any governmental position in any capacity. Nevertheless, the Order saw a reversal when Asoka De Silva became the Chief Justice,enabling Jayasundera to hold any position. The other hindrance for the new finance minister customarily is the new Governor of the Central Bank Nivard Cabraal, billed to take up the job shortly.

The two will be the key figures in the government, moving the pawns right across the political chessboard from the hallowed precincts of the State. Cabraal, as known to many, carries heavy baggage with him. His belongings are such the government may encounter difficulties to charter the way forward with him on the pinnacle of the principal financial institution of the State.

Alas, the Finance Minister painted a dismal picture of the economic situation in the country mainly caused by the unrelenting pandemic and other ills associated with the administration.

Where the solution exists is anybody’s guess! Nevertheless, there are examples in the global context of how countries have reemerged as vibrant economies after the strategic intervention of the International Monetary Fund.

Hence it is time to rethink and obtain proper advice to lead the country on the path of economic recovery prudently.

The recent Finance Bill passed by the government amidst vehement disagreement from the Opposition benches with the hope of raking in undeclared money by individuals, is yet another attempt by the government to replenish the government coffers.

The Bill passed in Parliament was given wide publicity through a brochure prepared by Ernst and Young.

The highlights are as follows:

The Finance Act passed in Parliament on September 7, 2021 essentially

provides for the following;

? Amnesty for undeclared income

? Write off of unpaid GST, ESC,

NBT, optional VAT, Debit Tax and SRL (amongst other duties and levies)

? Write off of unpaid income tax of individuals (including PAYE deducted by employer and not remitted)

? Write off of penalty and interest in relation to the Inland Revenue

Act, VAT Act, Betting and Gaming Act and Stamp Duty.

The amnesty

Amnesty is provided to any person who discloses income and assets which were not disclosed in an income tax return or VAT return in a year of assessment/tax period prior to March 31, 2020.

Benefits of the amnesty

Full immunity from tax, penalty, interest or investigation or prosecution under provisions of the Inland Revenue Act (Inland Revenue Acts of years 1979, 2000, 2006 and 2017 are included) and under the provisions of the VAT Act (unless the VAT has been collected by the declarant).

Time limit to claim the amnesty

The amnesty must be claimed before March 31, 2022.

Eligible persons

Any person including individuals, companies, funds, NGO’s, partnerships are eligible for the tax amnesty

Qualifying conditions

The following conditions need to be met prior to qualifying for the amnesty ;

1. Invest the undisclosed amount in any of the following prior to March 31, 2022

? Shares issued by a resident company

? Treasury Bills or bonds

? Quoted debt securities issued by a resident company

? Movable or immovable property in Sri Lanka

If a person is unable to immediately make the aforementioned investments, such amount should be deposited in a bank account (opened in a bank icensed under the Banking Act of Sri Lanka) prior to

March 31, 2022.

The above requirement will not apply if a person, prior to the commencement of this Act, has already invested an amount equal to the undisclosed amount in any of the above mentioned instruments, movable or immovable property (either in or outside Sri Lanka) or, has deposited same in a bank account.

2. Payment of “Tax on Voluntary Disclosure”

A person who intends to disclose an undisclosed amount is liable to pay tax at a rate of 1% of the undisclosed amount, or on the cost of the asset invested or deposited. If the disclosure is in relation to movable or immovable property, the tax of 1% is on the market value of such property at the date of the declaration.

Procedure

Upon the investment or deposit of the undisclosed amount and the payment of the tax on voluntary disclosure, a declaration must be submitted to the Commissioner General prior to March 31, 2022.

The format of this declaration is prescribed. in the Act. If the declaration is in accordance with the Act, the Commissioner General is to accept the declaration within 30 days. If the declaration is not in accordance with the Act, the Commissioner General has to reject it within 30 days giving reasons for same. A fresh application can be made if a declaration is rejected rectifying any defects therein.

The government is keen to determine how many people will be enticed by the new Finance Act. While the Opposition calls it a move to open doors to a tax haven, the government is however making desperate attempts to collect money as much as possible.

The fear is whether it would be a vehicle for money laundering where the financial charlatans have field day. (ALAKESHWARA)