Thailand’s richest billionaires and their wives filled an ornate hall in Bangkok’s sprawling Dusit Palace complex. In the front row of the gaggle, 20 people: The men dressed in white, military-style uniforms used for royal audiences, their wives in Thai-style, powder-blue long-sleeved blouses and wraps of Thai silk that shimmered in the brightly lit gilded room.

A hush came over the group as King MahaVajiralongkorn and Queen Suthida entered. The group had gathered in honor of the king’s birthday the previous month; it included the wealthiest patriarchs of the country’s Sino-Thai clans who have been the country’s unofficial oligarchy for years, each bearing two envelopes as gifts. The attendees were well known to each other; the same family names figure on the invite list year in and year out as old fortunes pass from generation to generation.

Held last year in August, the gathering included one new face: Sarath Ratanavadi, who in a few short years had vaulted to prominence as Thailand’s energy king. The then 55-year-old Sarath stood with his wife, Nalinee, on the far side of the group, the youngest face amid the aging tycoons and barons. Sarath was marked by his trim figure, medium height, thick eyebrows and penetrating eyes.

Sarath’s elevation to this ultimate circle of privilege came blindingly quick in a semi feudal society where wealth is mainly inherited and political connections count as much as business acumen. There was no public trace of Sarath’swealth before he mounted the Forbes list in 2018, a year after his company, Gulf Energy Development, the kingdom’s largest private power producer by market value, made its initial public offering. This year he is the country’s fifth-richest, worth $8.9 billion, according to the 2021 Forbes rich list.

By February, he had been awarded his first royal decoration, the Knight Grand Cross (First class) of the Most Noble Order of the Crown of Thailand, further cementing his place among the country’s uber-wealthy business elite.

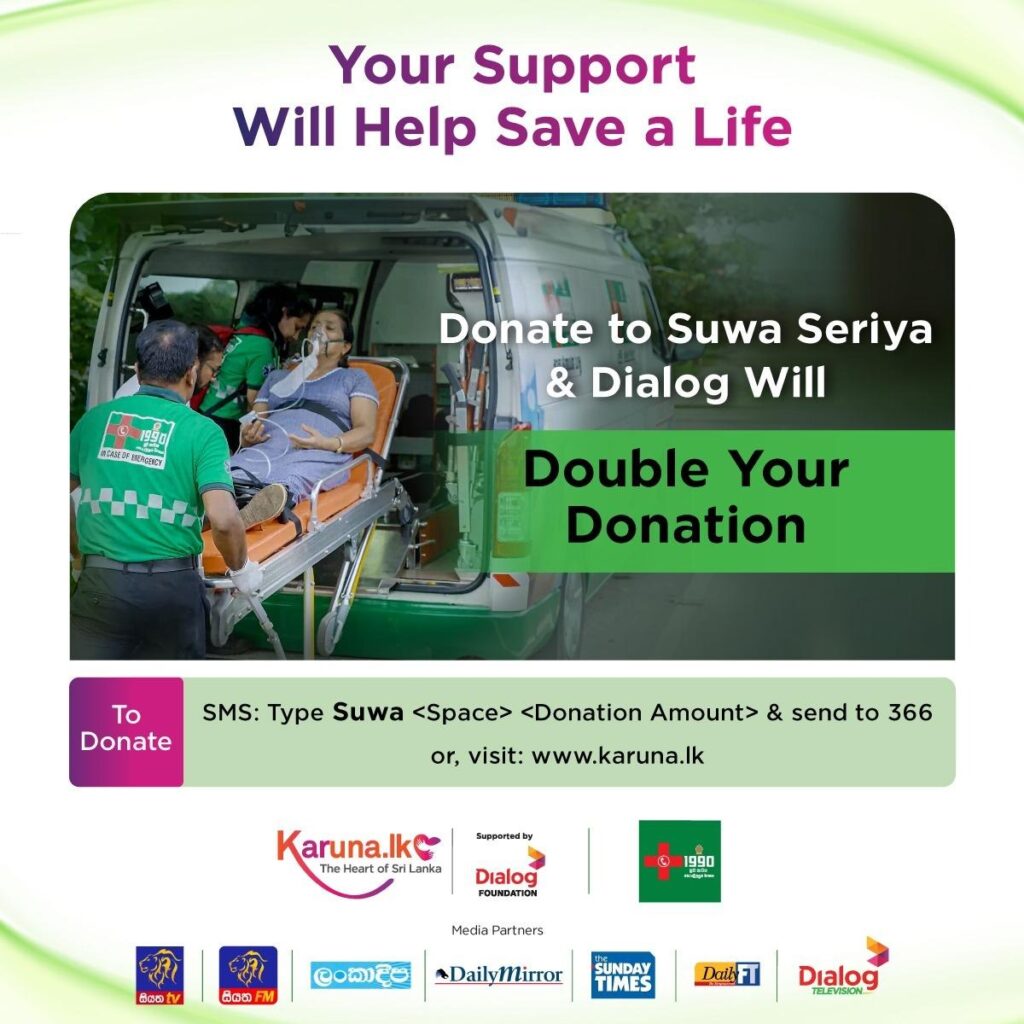

Thailand’s richest billionaires and their wives, including Sarath Ratanavadi and his wife Nalinee, pictured far right in front of the window, met with King Maha Vajiralongkorn and Queen Suthida in 2020. (Photo courtesy of Royal Household Bureau)

“Wow! That’s a bolt from the blue. Who is he?” blurted Kevin Hewison, a veteran Australian academic who specializes in Thai politics, when he spotted Sarath’s name on the Forbes list for the first time in 2018. Hewison at the time had just completed a paper, titled, “Crazy Rich Thais: Thailand’s Capitalist Class, 1980-2019.”

“I was also surprised to see someone move up so rapidly into the top five, which had remained pretty stable over the period 2006 to 2019,” he said.

Sarath is not just another run-of-the-mill billionaire, of which Thailand now has more than 50. His presence among the invitees to the palace “put [him] into a different layer, a different class by being in that exclusive group,” Chris Baker, a respected scholar of Thai politics,history and wealth, told Nikkei Asia. “It has clearly made Sarath more public, and he has outed himself by the message it conveys.”

The billionaire’s club

Scaling the heights of wealth and privilege so quickly is remarkable in any society but especially so in one that is, by many measures, the world’s most unequal.

Thailand’s political structure — a succession of 13 military juntas since 1932 and an enduring monarchy — makes social mobility especially tricky. Before Sarath joined the conclave at the king’s birthday, no new family names had been featured since the monarch ascended the throne after his father, the late King BhumibolAdulyadej, died in 2016.

Southeast Asia’s second-largest economy has straddled economic and social fault lines that pit the majority in the rural heartlands and urban pockets against a smaller, influential and well-heeled affluent class in Bangkok and other large cities. According to a study by the Bank of Thailand, the central bank, the average monthly household income went from 17,000 baht in 2014 to about 22,000 baht ($671) by 2020.

At the other end of the spectrum, Thailand’s 40 richest this year are worth $151.7 billion, or 28% of gross domestic product, according to Duangmanee Laovakul, an assistant professor at the Center for Research on Inequality and Social Policy at Thammasat University.

Thailand’s income gap in 2018 was the widest in the world, according to statistics published in the yearly Credit Suisse Global Wealth Databook. The top 1% controlled 66.9% of the country’s wealth that year. Although the indicator in 2020 contracted to 40%, in line with most countries during the pandemic, Thailand was still the world’s fifth-most unequal out of 40 nations rated by Credit Suisse.

The top tier’s rapid consolidation of their country’s wealth has made Thailand the high net worth capital of Southeast Asia, with 52 billionaires (worth at least $1 billion) last year, according to the Hurun Global Rich List — 10th in the world, while the economy counted in nominal GDP was the 22nd largest.

Reaching the top might be hard, but once one arrives, the atmosphere is collegial, according to Baker. “The Thai oligarchs help one another,” the political scholar said. “There is a camaraderie to help each other if one of them is in trouble. There have been times when there has been competition, yet they feel a greater need to stick together.”

Building an energy empire

To be tagged as an insider in Thailand’s power circles confirms the long distance Sarath has traveled since the early 1990s, when Thailand’s economic growth was galloping along at 8.2% per year. Armed with two engineering degrees, one from Bangkok’s prestigious ChulalongkornUniversity and the other from the University of Southern California, a young Sarath found opportunities as new energy policies were being rolled out.

The government had decided to end state control of the power supply and open the market to private independent utilities. The shift, made to meet growing energy demand, resulted in a “gold rush,” as some describe. “By going into energy [Sarath] did not join the rest of his generation,” a longtime acquaintance recalled. Most of the newly minted graduates from Bangkok’s elite universities were drawn to the booming world of finance.

A power plant operated by GSRC, a Gulf Energy subsidiary, in Chonburi Province, Thailand. The plant has a power generation capacity of 2,650 MW. (Photo courtesy of Gulf Energy)

In a country where generals hold sway, Sarathhas benefited from his military pedigree. His father, Gen. Thaworn Ratanavadi, was considered close to Gen. Suchinda Kraprayoon, the strongman who in 1991 staged a coup to overthrow an elected government. His grandfather, Sode Ratanavadi, also a military officer, was involved in a political party that overthrew the monarch in 1932, ending then-Siam’s absolute monarchy.

His wife, Nalinee, hails from a wealthy Thai-Chinese political dynasty in Tak, a northwestern province along the Thai-Myanmar border.

“[Sarath’s] wife has been key, and his father-in-law owns a business empire in Tak, so Sarathhad money and strong connections when he came back from the U.S.,” said Suwat Sinsadok, managing director of FSS International Investment Advisory Securities, a Bangkok business consultancy. Sarath consults Suwatbefore making business decisions. “But he was very focused even then,” Suwat added. “From 1994, Sarath saw power as the future.”

Sarath built his energy empire under the Gulf brand name. His first foray, in 1994, was with Gulf Electric, which won a bid to build a coal-fired power plant south of Bangkok. These were heady days; economic reforms invited private companies into the power production sector, ending a decadeslong state monopoly. But Sarath ran into stiff grassroots environmental protests, and his project stalled.

A decade later, with Thailand being governed by a billionaire prime minister, Thaksin Shinawatra, Sarath again invested in power, this time in the central province of Saraburi and this time gas-fired plants rather than coal. By then, Sarath had the backing of J-Power, a Japanese utility that had a 49% stake in Gulf Electric.

More money, more problems

But Sarath’s business model — winning state concessions to produce power — veered back into controversy in 2013, when Thaksin’s sister, Yingluck, was serving as prime minister. A Gulf-affiliated company won bids to build gas turbines in Chonburi and Rayong provinces that could generate a total of 5,300 megawatts. But by scooping up the entire concession, the company raised eyebrows as four other companies who had vied for shares were left in the cold.

Independent Power Development, the winning Gulf subsidiary, was 30% owned by Japan’s Mitsui & Co. Its chairman at the time of the tender was Viset Choopiban, an energy minister under Thaksin and a former president of PTT, Thailand’s state-owned oil and gas company.

The concession was thrown into question a year later following the most recent coup in 2014, staged by Gen. Prayuth Chan-ocha, then the powerful chief of Thailand’s army. The junta was determined to pry open any favorable deals that benefited Thaksin-aligned business leaders during his sister’s time in office. “One of the reasons his competitors hated Sarath was because of him winning this deal 100%,” a Thai energy industry insider said. “They cheered the coup, welcomed the inquiry and expected the military regime to strike down the Gulf deal.”

Police officers and soldiers stand guard during a protest against military rule at Victory Monument in central Bangkok on May 26, 2014, after a coup led by current Prime Minister Prayuth Chan-ocha. © Reuters

Preliminary inquiries by the energy ministry pushed for the deal to be renegotiated, citing irregularities, and in the early post-putsch days, Sarath was summoned by the military regime. But Thai media at the time paid little heed to the still unknown power broker, whose name was misspelled on the summons. Their coverage instead centered on Thailand’s better-known billionaires, many from the real estate and construction sectors, who were among 400 prominent people taken to military bases and interrogated.

However, following extended negotiations, the cloud hanging over the deal lifted. In December 2016, Prayuth issued an order that countermanded a previous order targeting the concession. The outcome also pleased PichaiNaripthaphan, who was energy minister when Yingluck was in power and the concession was granted. “Gulf won that bid fair and square,” Pichai told Nikkei. “It offered the lowest price.” (In Thailand, when companies bid for power-producing projects, the bidders offer to produce power at the lowest cost per unit to be sold to the state utility.)

That turnaround paved the way for Gulf Energy’s IPO in 2017, by which time the group had 13 gas-fired power stations in operation and installed generation capacity was over 4,771 MW.

Like that, Sarath found himself as the CEO and largest shareholder of a company that made for Thailand’s biggest corporate listing in over a decade, raising $733 million. But there was nothing sudden about it.

“He prepared for that listing for more than 10 years,” Suwat, the business analyst, said. “He waited for the right time.”

What stood out was Sarath’s ability to win the blessings of the Prayuth regime. He managed this despite being close to the Shinawatras.

“Given his closeness to the former government, no one who has migrated to the other side and managed to cultivate allies in the new regime has done as well as Sarath,” said an investment banker who has followed the energy tycoon’s rise. A power industry insider concurred: “He not only survived the post-coup purge but he springboarded, and he reportedly is still on good terms with Thaksin.”

Thaksin, whose government was ousted by a coup in 2006 while the prime minister was in New York for a United Nations General Assembly gathering, now lives in self-imposed exile in Dubai.

Since the listing, Sarath has used legal threats to deal with critics of his extraordinarily lucrative deals. In February, Gulf Energy filed a lawsuit accusing Bencha Saenchantra, a female opposition parliamentarian, of libel after she alleged that some of the state’s policies had favored Gulf and Sarath during a censure motion in parliament against Prayuth early this year. “That was the first time I spoke in public about Gulf,” she told Nikkei. She queried the conditions under which Gulf won bids as part of a consortium for two power-related megaprojects. Under Thai law, lawmakers have legal protections for what they say in parliament, though they can be charged with libel if their comments are broadcast to a wider audience.

The company had previously sued Sirichai Mai-Ngam, the former president of one of the country’s largest trade unions, at the Electricity Generating Authority of Thailand, a state utility, after he raised questions in a Thai newspaper about the 5,300 MW concession won while Yingluck was in power. The case was settled out of court.

That Sarath and Gulf remain sensitive about the 5,300 MW deal is reflected in the company’s latest annual report, filed last December. Toward the end of the report is a summary under the subhead “litigation.” It begins by noting that the deal came under scrutiny following the 2014 coup. It also notes efforts during the military regime to undo the deal, the move by the state for the Board of Investment to delay the bidding process, and Gulf’s mixed results to win favorable rulings on issues it raised in the courts.

The report says that the company in 2020 made no provision related to the litigation because “the Group’s management believes that there will be no significant liability from the result of the above lawsuit cases.”

Friends in high places

The legal campaign does little to change the perceptions that successful companies like Gulf face in Thailand, particularly when fortunes have flowed from government concessions. “Gulf’s main revenues stem from long-term state concessions, usually 25-year contracts” linked to the state power utility, said VeerayoothKanchoochat, a Thai political economist at the Tokyo-based National Graduate Institute for Policy Studies. In other words, the government is Gulf’s main customer, and the customer has guaranteed sales for the next 25 years.

Prime Minister Prayuth Chan-ocha and former Prime Minister Thaksin Shinawatra. Sarath has been able to strike energy deals under the governments of each, despite tensions between Thaksin and Prayuth. (Source photos by Reuters and Getty Images)

Sarinee Achavanuntakul, head of Sal Forest, a Thai research company, considers Gulf Energy as one of 57 “political stocks” traded in Thailand. There are three such categories, she says. First, there are stocks of listed state-owned enterprises and government-owned companies. There are also stocks of companies whose main income is from government concessions. Finally, there are stocks whose owners have close family or friendly ties with powerful politicians. “Gulf fits squarely [within the second category],” she said, “and I think many Thai people would regard [it] to fit [into the third] category as well.”

Sarath’s tale is not exactly rags to riches, more like rich to insanely rich. Arriving at the summit of Thai society, he immediately benefited from a new billionaire-centric economic model being pioneered by Prayuth’s regime. It has acted to cement the fortunes of the oligarchy in a new social compact called Pracha Rath Rak Samakee(people of the state love harmony).

This Orwellian-sounding 2016 initiative offered incentives, including generous tax breaks, to persuade big businesses to rub shoulders with the generals and support the junta’s economic solution for rampant inequality. “In doing so, the Prayuth regime changed the relationship between the Thai state and big business in a way we had not witnessed before,” said PrajakKongkirati, a political scientist at Bangkok’s Thammasat University and co-author of a paper, “The Prayuth Regime: Embedded Military and Hierarchical Capitalism in Thailand.”

Prajak added, “They matched the bureaucracy with the top 20 businesses, and the businesses ended up gaining more as they penetrated into the [small and medium sector] markets to strengthen their monopolies.”

Sarath’s proximity to Prayuth, now the prime minister of a pro-military government that succeeded the junta after general elections in 2019, was laid bare after COVID-19 struck Thailand last year. In April, Prayuth sent a letter to the country’s 20 richest people his government was close to, seeking their help to revive an economy that was sinking after the first wave of the pandemic began to bite. The Thai media listed the names of the likely recipients of Prayuth’s missive. Sarath’s name appeared high on the list. Dhanin Chearavanontwas also on the list. The 82-year-old presides over the CP Group, an agribusiness conglomerate. He heads Thailand’s richest clan and is said to be worth $30.2 billion, making him Thailand’s richest billionaire. Charoen Sirivadhanabhakdi made the list as well. The 77-year-old heads Thai Beverage, the beer and liquor conglomerate, and is the country’s third-richest tycoon. His wealth is estimated at $12.7 billion.

In the rarefied world of Thai high-rollers, Sarathstamped his new reputation by often traveling in his new, private (Gulfstream) plane, reportedly worth $70 million. Sarath is known as a good golfer with a single handicap, and a lover of fine wines. But to many associates, even close ones, he is a cipher, obsessed with privacy. Finding a photograph of him is difficult; the only one that is public is on Gulf Energy’s annual report.

Dhanin Chearavanont, left, Sarath Ratanavadiand Charoen Sirivadhanabhakdi are believed to be among the 20 richest people close to Prime Minister Prayuth. The Sarath photo, from Gulf Energy, is one of the few of Sarath available. (Source photos by Kosaku Mimura, Gulf Energy, and Getty Images)

He rarely gives media interviews, and acquaintances affirm he is fiercely private. Gulf Energy declined to make Sarath or any other senior executive available to Nikkei for an interview. Sarath “is known as a private person,” confided a former cabinet minister who has moved in the same social circles as Sarath. Consequently, there is an air of mystery about his wealth and the size, scale and speed of his company’s growth — the recipe for his success in Thailand.

Bangkok-based diplomats say they consider Gulf as a company to watch. Hitherto, they paid most of their attention to the “Big 5.” The shorthand refers to the five Sino-Thai conglomerates: the CP Group, Thai Bev, the duty-free monopoly King Power International Group, dominant high-end retail trader Central Group and Singha beer maker BoonrawdBrewery.

“The same way we pay attention to the Big 5, we have begun to pay attention to Gulf as the next tier of influence,” a diplomat from a Western embassy revealed to Nikkei. Another diplomat said Thailand is a country where “often the big families are very influential and have a lot of sway over politics, policies and positions.” But while the other families have been more accessible and even attend occasional embassy events, Sarath, he noted, is an enigma who has remained quiet and below the news radar as his wealth has surged.

Gulf Energy’s JP UT power plant, in Thailand’s Ayutthaya Province, has a generation capacity of 1,600 MW. The plant was backed by several Japanese banks, including Mitsui. (Photo courtesy of Gulf Energy)

Only a trusted few appear to have penetrated this air of mystery hovering over Bangkok’s newly minted billionaire. Suwat, the analyst, is one of them. In February, he met Sarath for lunch in the private room of an elegant Italian restaurant on the ground floor of a 43-story tower on Bangkok’s embassy row. It was to discuss Sarath’s groundbreaking multibillion-baht deal that was poised to shake up Thailand’s telecoms sector. The lunch of salad and spaghetti lasted for three hours, Suwat recalled, as Sarath rolled out Gulf’s bid to invest in InTouch Holdings, which controls Advanced Info Service, Thailand’s largest mobile phone operator.

“Other [Thai] power companies are different,” Suwat said. “They grow as the market grows, more organic. Gulf is very different. [Its] empire is much bigger and more aggressive. … You cannot find a company like this in Thailand.”

Additional reporting by Akane Okutsu in Tokyo.